How To Report Bad Debt On 1040

To report your share of a gain or loss from a partnership S corporation estate or trust. However corporations report this.

Write Off An Unpaid Sales Invoice With Sales Tax As Bad Debt Manager Forum

1040-SR line 7 or effectively connected capital gain distributions not reported directly on Form 1040-NR line 7.

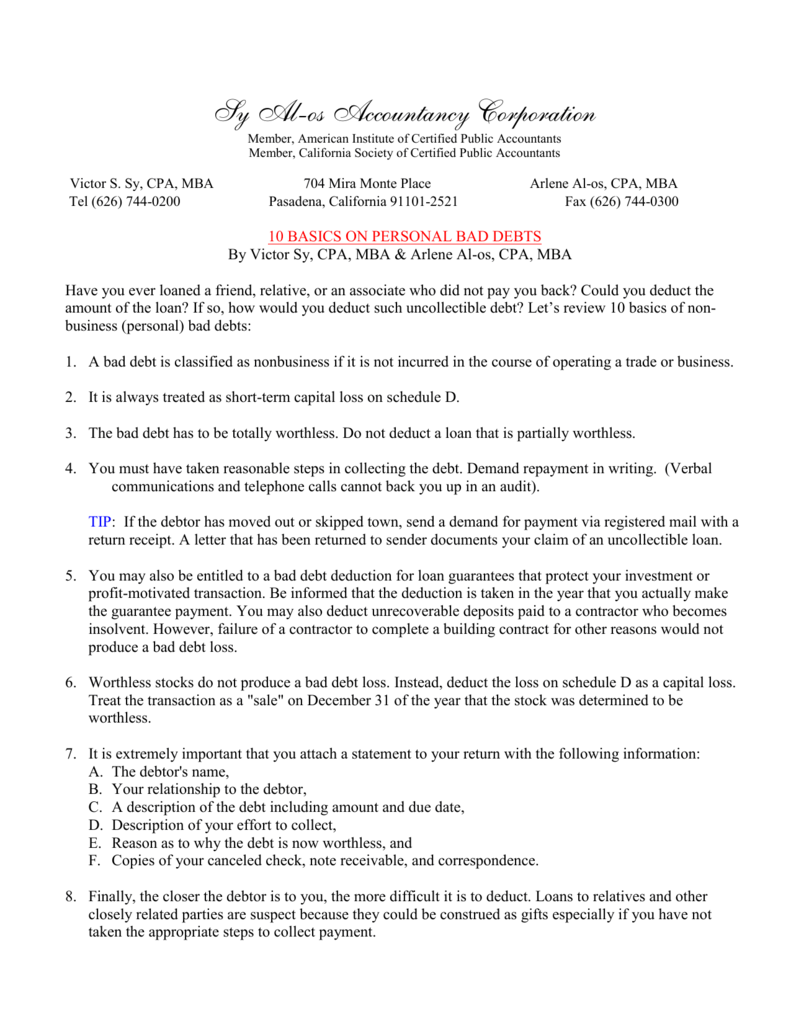

How to report bad debt on 1040. However if any part of the earlier deduction didnt reduce your tax you dont have to report that part as income. To report a capital loss carryover from the previous tax year to the current tax year. Form 1040 the rules discussed also apply to Schedule D Form 1041 Schedule D Form 1065 Schedule D Form 1120.

You must report the bad debt deduction taken in the earlier year as income in the year of repossession.

Solved Turbotax Premier 2020 Can T Enter Uncollectible De

How To Write Off Bad Debt For Unpaid Loans Friends Owe You

How To Write Off Bad Debt Effects And How To Reduce Bad Debt

How To Report Non Business Bad Debt On A Tax Return Turbotax Tax Tips Videos

How To Write Off Bad Debt For Unpaid Loans Friends Owe You

Business Bad Debt Deduction Helps Owners Cut Losses

Bad Debts 1 10 Basics Non Business

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/WhatIsBadDebtRecoveryNov.222021-94d3dd02214b4e53b6f64723b7e42b33.jpg)

Belum ada Komentar untuk "How To Report Bad Debt On 1040"

Posting Komentar